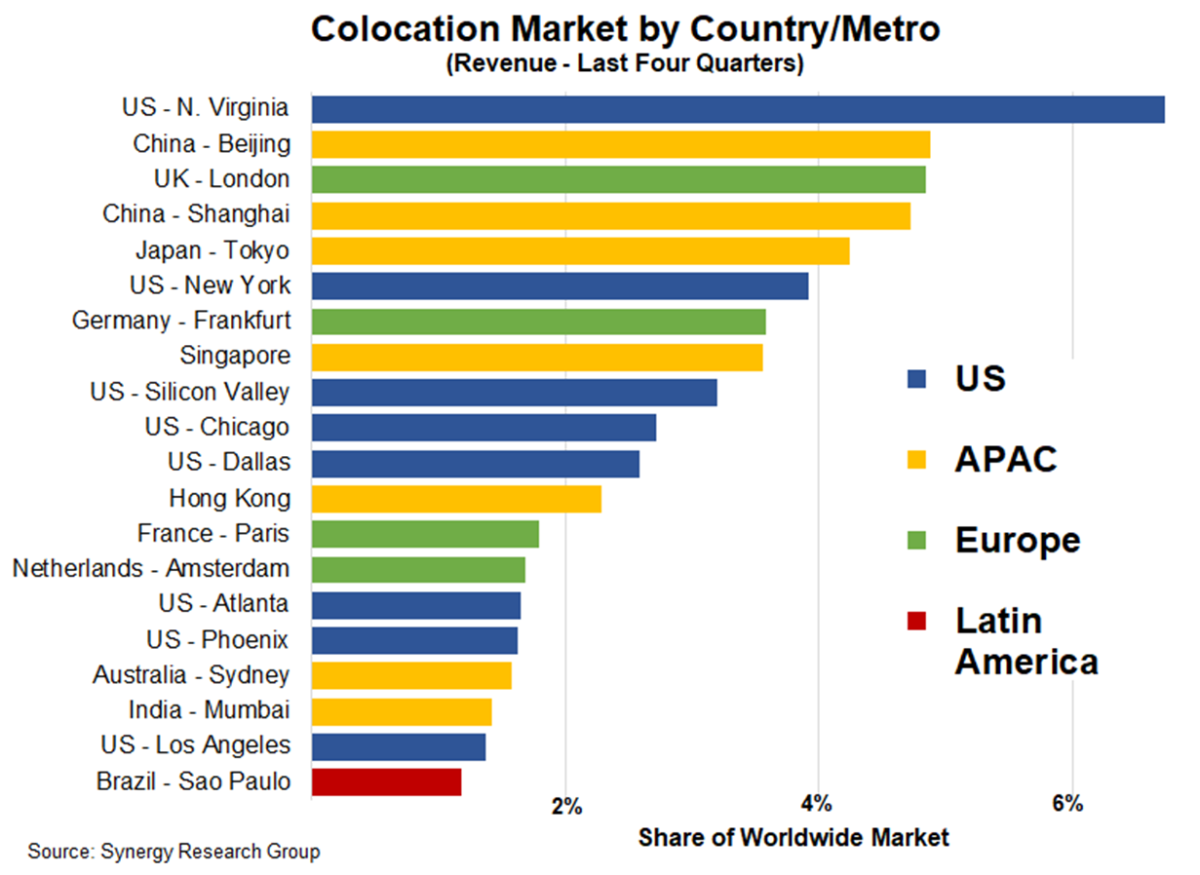

Northern Virginia is the single biggest market, accounting for almost 7% of the total. It is followed by Beijing, London and Shanghai, each accounting for around 5% of the total, and then Tokyo at 4%. Of the top 20 markets, eight are in the US, seven in the APAC region, four in Europe and one in Latin America. After the top 20, the next twenty largest state or metro markets account for another 13% of the market, with the US and Europe featuring more prominently in that batch. Northern Virginia is a unique market. The area was foundational to the early years of Internet infrastructure and has remained a center of gravity for data center activity, benefitting from a rich networking ecosystem, a business-friendly environment and a good supply of low-cost power. Beyond Northern Virginia, the other leading colocation markets mainly reflect the world's leading economic hubs. Outside of the top forty markets, some metros are growing extremely rapidly including Johor, Jakarta, Chennai, Lagos, Rio de Janeiro, Johannesburg and Queretaro.

The research is based on Synergy's in-depth quarterly tracking of colocation markets, including both retail and wholesale segments. Synergy provides quarterly revenue data for almost 300 colocation companies, with breakouts for over 50 countries and 85 individual metro markets. There is a strong local and national aspect to colocation, but on a worldwide basis the leading companies are Equinix, Digital Realty, NTT, China Telecom, CyrusOne and GDS.

"Proximity to customers is a key driver of the colocation market, so data centers tend to be located in metros that have a large concentration of companies and economic activity. That will not change but what we are seeing is the increasing emergence of many metros in countries that have smaller economies, but which are growing rapidly," said John Dinsdale, a Chief Analyst at Synergy Research Group. "Countries like Malaysia, Indonesia, Nigeria and South Africa are all interesting opportunities, while in Latin America the market has developed beyond the historic focal point of Sao Paulo, and we're now seeing high growth in metros like Santiago, Rio de Janeiro and Queretaro. It is also the case that increasingly there are power or geographic constraints limiting growth in some traditional metros, pushing growth opportunities into neighboring regions. These emerging metro markets will not reach the scale of a Singapore or a Frankfurt any time soon, but they will increasingly reshape the evolving colocation market."