"The AI market continues to grow at a steady rate in 2019 and we expect this momentum to carry forward," said David Schubmehl, research director, Cognitive/Artificial Intelligence Systems at IDC. "The use of artificial intelligence and machine learning (ML) is occurring in a wide range of solutions and applications from ERP and manufacturing software to content management, collaboration, and user productivity. Artificial intelligence and machine learning are top of mind for most organizations today, and IDC expects that AI will be the disrupting influence changing entire industries over the next decade."

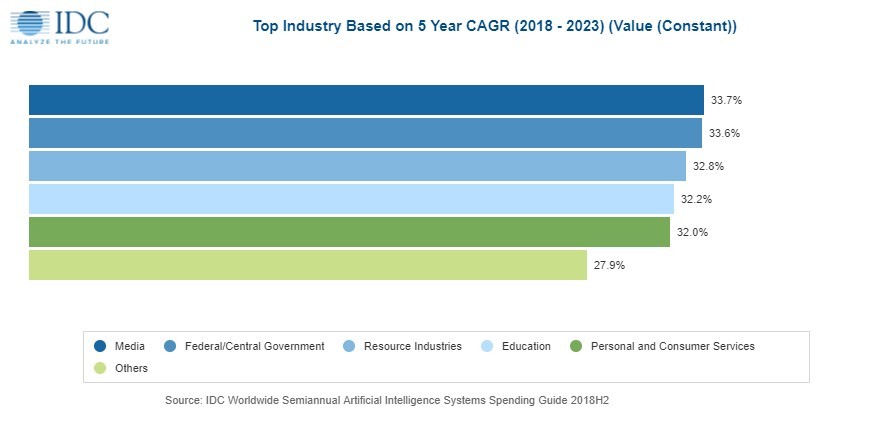

Spending on AI systems will be led by the retail and banking industries, each of which will invest more than $5 billion in 2019. Nearly half of the retail spending will go toward automated customer service agents and expert shopping advisors & product recommendation systems. The banking industry will focus its investments on automated threat intelligence and prevention systems and fraud analysis and investigation. Other industries that will make significant investments in AI systems throughout the forecast include discrete manufacturing, process manufacturing, healthcare, and professional services. The fastest spending growth will come from the media industry and federal/central governments with five-year CAGRs of 33.7% and 33.6% respectively.

"Artificial Intelligence (AI) has moved well beyond prototyping and into the phase of execution and implementation," said

Marianne D'Aquila, research manager,

IDC Customer Insights & Analysis. "Strategic decision makers across all industries are now grappling with the question of how to effectively proceed with their AI journey. Some have been more successful than others, as evidenced by banking, retail, manufacturing, healthcare, and professional services firms making up more than half of the AI spend. Despite the learning curve, IDC sees higher than average five-year annual compounded growth in government, media, telecommunications, and personal and consumer services."

Investments in AI systems continue to be driven by a wide range of use cases. The three largest use cases – automated customer service agents, automated threat intelligence and prevention systems, and sales process recommendation and automation – will deliver 25% of all spending in 2019. The next six use cases will provide an additional 35% of overall spending this year. The use cases that will see the fastest spending growth over the 2018-2023 forecast period are automated human resources (43.3% CAGR) and pharmaceutical research and development (36.7% CAGR). However, eight other use cases will have spending growth with five-year CAGRs greater than 30%.

The largest share of technology spending in 2019 will go toward services, primarily IT services, as firms seek outside expertise to design and implement their AI projects. Hardware spending will be somewhat larger than software spending in 2019 as firms build out their AI infrastructure, but purchases of AI software and AI software platforms will overtake hardware by the end of the forecast period with software spending seeing a 36.7% CAGR.

On a geographic basis, the United States will deliver more than 50% of all AI spending throughout the forecast, led by the retail and banking industries. Western Europe will be the second largest geographic region, led by banking and discrete manufacturing. China will be the third largest region for AI spending with retail, state/local government, and professional services vying for the top position. The strongest spending growth over the five-year forecast will be in Japan (45.3% CAGR) and China (44.9% CAGR).